Credit bureaus

Did you know that there are 2 credit bureaus in Canada? That’s right 2!

They are TransUnion Canada and Equifax Canada.

You have always been able to receive your Credit Bureau Report free by mail. You can download a request form, send it by fax or snail mail to the credit bureaus, and several weeks or months later they will send you a copy of your credit bureau report in the mail at no cost. However, they will not send you your credit score.

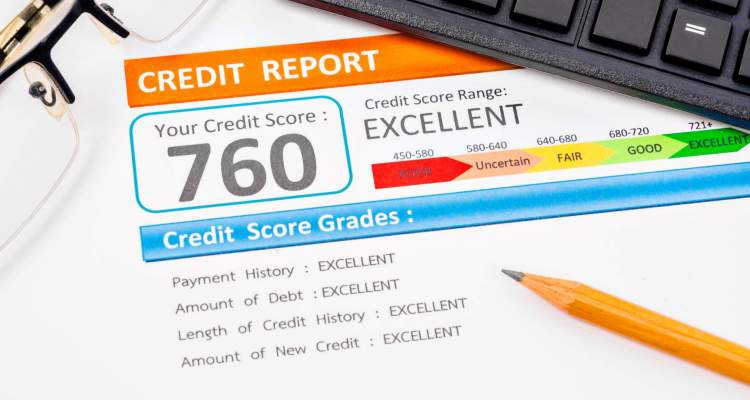

Things to know about credit scoring

Credit scoring is the information that your creditors rely on when they are making a lending decision and that information is only available to consumers online.

Point scoring can range from 300 – 900 points – depending on the bureau system.

- 300 hundred points – you are new to credit (just getting started)

- 900 points – you walk on water (you should qualify for almost anything)

Every time someone pulls your credit file you lose points – so do not apply for credit that you do not want or that you know you will not qualify for.

- A lender should never deny a loan solely on the basis of a credit score.

- A low score may simply indicate a need to more carefully scrutinize a potential borrower. Besides, a credit score is just a snapshot in time.

- Any change in credit activity or performance will result in a change to the score. For example, if derogatory information is reported for an account, the credit score will decrease. If a consumer works to remove this derogatory information, the score will increase.

- A score of more than 660 can simply require basic review by the credit grantor, 660 down to 620 may require a comprehensive analysis.

- A score of 620 or lower will dictate a cautious, detailed study.

If your score happens to be low, you may want to work to improve it.

Raise your credit score

- Cut down your debt.

- Pay your bills on time, even if it’s just the minimum due.

- Don’t max out your credit cards.

- Don’t add new credit cards unnecessarily – write in and close any you have but don’t use.

- Check your credit score and credit report before making any applications to lenders.

- Avoid tax liens and bankruptcy filings.

- Student loans now report to the credit bureaus – so pay them as agreed

- Credit Counselling programs will provide you with a better credit rating than filing for bankruptcy.

- Check your credit report once a year, and read carefully to make sure it’s accurate.

- Getting out of high-interest debt is in itself a substantial boost to your credit score.

- If you have money in savings use it to pay down expensive credit card balances – balances that will cost you more money in the long run and possibly points.

- Cut down on your debt – you don’t have to go bankrupt to know that you have overspent – or that you are in over your head.

Pay your bills on time

It is important that you keep (current), your monthly payments and bills. Many financial institutions and credit card companies charge late fees on over-due accounts as well as report the late payments to the credit bureaus. There is an interest charge on the account as well.

- Simple Interest – calculated from payment date to payment date on the principal balance. You don’t pay interest on interest.

- Compound Interest – calculated daily on the current balance. This means that you are paying interest on interest. This is what happens when you use one credit card to pay the other credit card.

If you are unable to pay your bills as agreed, contact your creditors and explain your situation or contact a qualified credit counsellor and ask for help. Any month you cannot fully pay credit card charges signals financial trouble and will reflect on your credit rating thus lowering your credit score.